All Categories

Featured

Table of Contents

If you're a person with a reduced tolerance for market fluctuations, this understanding could be important - Flexible premium IUL. Among the important facets of any type of insurance coverage is its price. IUL plans often come with various fees and charges that can affect their total worth. An economic expert can break down these expenses and help you consider them versus other low-cost financial investment choices.

Yet don't just think about the premium. Pay certain attention to the plan's functions which will certainly be essential depending upon exactly how you wish to make use of the plan. Speak with an independent life insurance policy representative that can aid you pick the finest indexed universal life policy for your demands. Complete the life insurance policy application completely.

Review the plan carefully. If satisfying, return authorized shipment receipts to obtain your global life insurance policy protection effective. Make your initial premium settlement to trigger your policy. Now that we have actually covered the advantages of IUL, it's necessary to recognize exactly how it compares to various other life insurance plans available in the marketplace.

By understanding the resemblances and differences in between these plans, you can make a much more informed choice concerning which kind of life insurance policy is ideal suited for your requirements and economic objectives. We'll begin by contrasting index universal life with term life insurance policy, which is often taken into consideration one of the most uncomplicated and inexpensive sort of life insurance policy.

What is the process for getting Iul Policyholders?

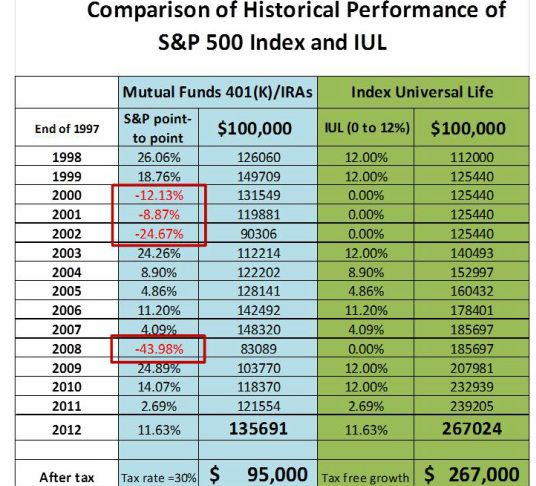

While IUL might give greater possible returns as a result of its indexed cash worth development mechanism, it also features higher premiums contrasted to term life insurance policy. Both IUL and entire life insurance are kinds of irreversible life insurance coverage policies that provide survivor benefit security and cash value development chances (IUL vs term life). Nevertheless, there are some essential differences in between these 2 kinds of plans that are necessary to take into consideration when choosing which one is ideal for you.

When thinking about IUL vs. all various other types of life insurance policy, it's vital to consider the advantages and disadvantages of each plan kind and talk to a skilled life insurance policy representative or monetary advisor to determine the most effective option for your distinct demands and monetary goals. While IUL supplies several advantages, it's additionally vital to be familiar with the risks and considerations connected with this sort of life insurance coverage policy.

Allow's delve deeper into each of these threats. One of the main worries when thinking about an IUL policy is the numerous costs and charges connected with the plan. These can consist of the price of insurance, plan charges, abandonment charges and any type of added cyclist prices sustained if you add added benefits to the policy.

Some may supply more affordable rates on protection. Inspect the investment alternatives available. You want an IUL policy with a range of index fund options to satisfy your needs. See to it the life insurer straightens with your individual economic goals, needs, and threat resistance. An IUL policy should fit your particular situation.

What is Guaranteed Indexed Universal Life?

Indexed global life insurance policy can provide a variety of advantages for insurance holders, consisting of adaptable costs payments and the possible to earn greater returns. Nonetheless, the returns are limited by caps on gains, and there are no guarantees on the marketplace efficiency. Overall, IUL plans supply numerous potential benefits, but it is necessary to recognize their dangers as well.

Life is ineffective for most individuals. It has the possibility for big financial investment gains however can be unforeseeable and costly contrasted to traditional investing. In addition, returns on IUL are usually low with considerable fees and no warranties - IUL account value. Generally, it relies on your needs and objectives (Indexed Universal Life). For those looking for foreseeable long-term financial savings and guaranteed survivor benefit, whole life may be the far better choice.

Iul

The advantages of an Indexed Universal Life (IUL) policy include potential greater returns, no downside threat from market movements, security, versatile settlements, no age demand, tax-free death advantage, and funding accessibility. An IUL policy is long-term and gives cash value development with an equity index account. Universal life insurance coverage began in 1979 in the USA of America.

By the end of 1983, all major American life insurance companies used universal life insurance policy. In 1997, the life insurance provider, Transamerica, presented indexed global life insurance coverage which offered insurance holders the capacity to connect plan development with global securities market returns. Today, universal life, or UL as it is additionally recognized comes in a selection of various forms and is a significant component of the life insurance policy market.

The info provided in this short article is for educational and informational purposes just and need to not be construed as financial or financial investment guidance. While the writer has knowledge in the subject, readers are suggested to seek advice from a qualified monetary advisor prior to making any type of investment decisions or acquiring any life insurance coverage products.

What types of Iul Vs Term Life are available?

As a matter of fact, you might not have assumed a lot about how you intend to spend your retired life years, though you possibly understand that you do not wish to lack money and you would certainly like to maintain your current way of life. [video: Text appears next to the business man speaking to the camera that reads "company pension", "social security" and "savings".] < map wp-tag-video: Text shows up beside the business man talking to the cam that reviews "company pension", "social protection" and "cost savings"./ wp-end-tag > In the past, individuals relied on three main sources of income in their retirement: a company pension, Social Protection and whatever they would certainly taken care of to save

Fewer companies are providing typical pension plan strategies. Also if benefits haven't been reduced by the time you retire, Social Safety alone was never ever planned to be adequate to pay for the way of living you desire and are entitled to.

Prior to committing to indexed universal life insurance policy, here are some pros and disadvantages to consider. If you choose an excellent indexed universal life insurance policy strategy, you might see your cash value expand in value. This is helpful because you might have the ability to accessibility this money prior to the strategy expires.

What are the top Iul Investment providers in my area?

If you can access it early on, it might be helpful to factor it into your. Since indexed global life insurance policy calls for a particular level of threat, insurer have a tendency to maintain 6. This kind of plan also supplies. It is still guaranteed, and you can readjust the face quantity and cyclists over time7.

Normally, the insurance policy company has a vested interest in doing much better than the index11. These are all variables to be thought about when picking the best type of life insurance coverage for you.

Given that this type of plan is extra intricate and has an investment part, it can usually come with greater costs than other policies like whole life or term life insurance. If you do not believe indexed universal life insurance policy is best for you, below are some alternatives to take into consideration: Term life insurance policy is a temporary policy that generally provides insurance coverage for 10 to thirty years

Table of Contents

Latest Posts

Minnesota Life Iul

Seguros Universal Insurance

What Is Group Universal Life

More

Latest Posts

Minnesota Life Iul

Seguros Universal Insurance

What Is Group Universal Life