All Categories

Featured

Table of Contents

It's vital to note that your money is not directly purchased the stock exchange. You can take cash from your IUL anytime, however fees and give up fees might be related to doing so. If you require to access the funds in your IUL policy, evaluating the advantages and disadvantages of a withdrawal or a financing is important.

Unlike straight financial investments in the supply market, your cash money value is not straight bought the underlying index. Rather, the insurer makes use of economic instruments like options to connect your cash money value growth to the index's performance. Among the special functions of IUL is the cap and floor prices.

How can I secure Indexed Universal Life Companies quickly?

The death benefit can be a set amount or can consist of the money worth, depending on the policy's structure. The cash money worth in an IUL policy expands on a tax-deferred basis.

Always evaluate the policy's information and seek advice from an insurance policy expert to fully comprehend the advantages, restrictions, and costs. An Indexed Universal Life Insurance policy (IUL) provides an one-of-a-kind mix of features that can make it an attractive option for specific individuals. Right here are some of the crucial advantages:: Among one of the most attractive facets of IUL is the capacity for higher returns compared to various other kinds of permanent life insurance coverage.

Why is High Cash Value Indexed Universal Life important?

Withdrawing or taking a funding from your policy may reduce its cash money worth, survivor benefit, and have tax implications.: For those curious about heritage preparation, IUL can be structured to supply a tax-efficient way to pass wide range to the future generation. The fatality benefit can cover estate taxes, and the cash money value can be an added inheritance.

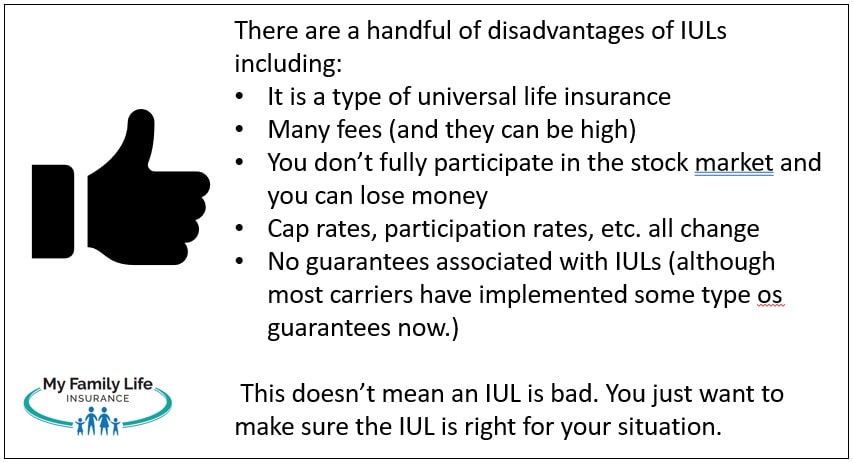

While Indexed Universal Life Insurance Policy (IUL) supplies a series of benefits, it's necessary to think about the potential disadvantages to make an educated decision. Below are a few of the essential drawbacks: IUL plans are much more complex than traditional term life insurance policy policies or entire life insurance policy plans. Comprehending just how the cash worth is linked to a supply market index and the effects of cap and floor prices can be testing for the ordinary consumer.

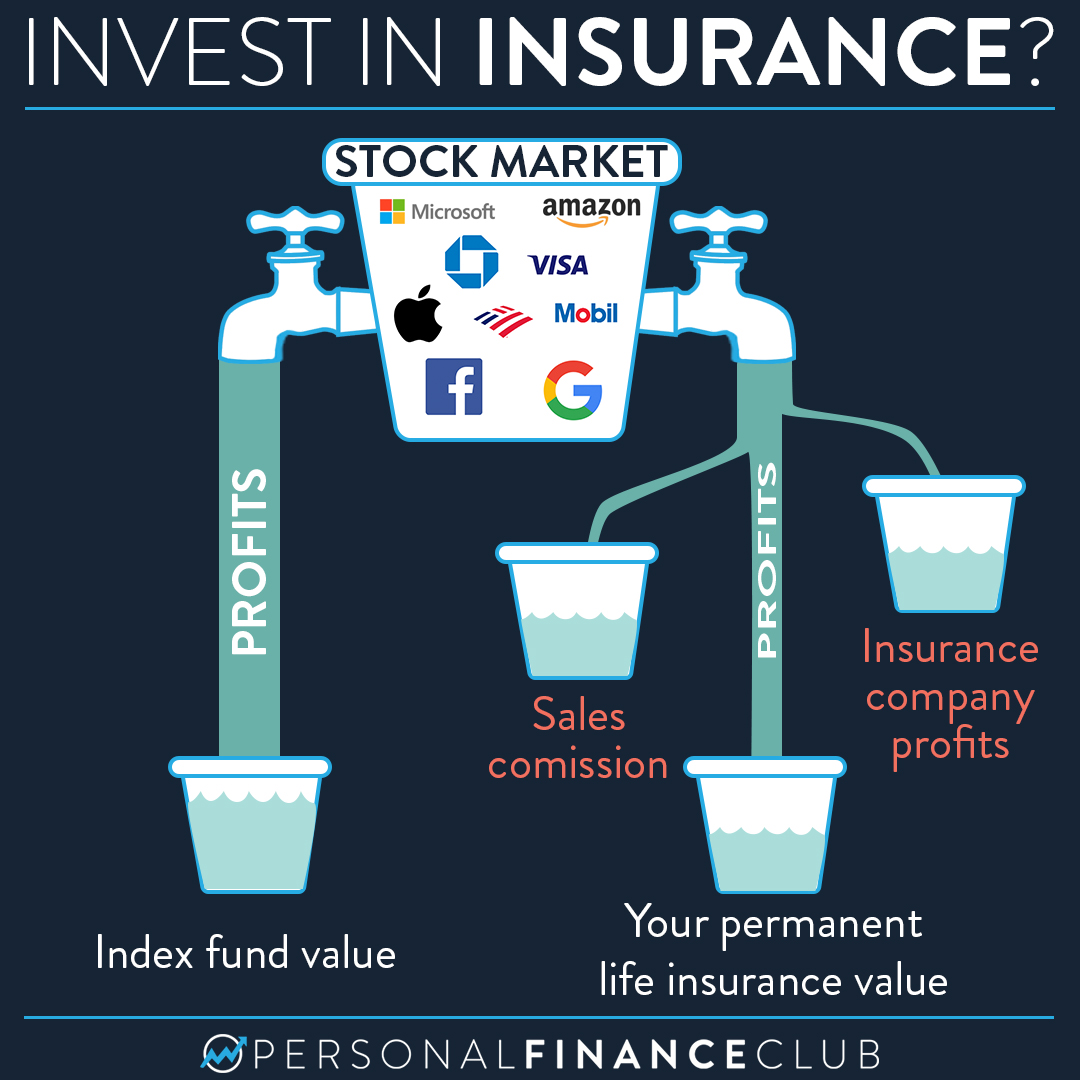

The premiums cover not just the price of the insurance but also management fees and the investment part, making it a costlier option. Indexed Universal Life loan options. While the cash worth has the possibility for development based upon a stock exchange index, that development is typically covered. If the index carries out incredibly well in a given year, your gains will certainly be restricted to the cap price specified in your plan

: Including optional attributes or cyclists can enhance the cost.: Exactly how the plan is structured, including exactly how the money value is assigned, can also affect the cost.: Various insurance provider have various pricing designs, so shopping around is wise.: These are fees for taking care of the plan and are typically subtracted from the cash value.

Who has the best customer service for Indexed Universal Life Financial Security?

: The expenses can be comparable, but IUL offers a flooring to help shield against market slumps, which variable life insurance coverage policies usually do not. It isn't very easy to offer an exact cost without a certain quote, as costs can vary considerably in between insurance coverage companies and specific scenarios. It's vital to balance the importance of life insurance coverage and the requirement for added security it offers with potentially higher premiums.

They can aid you comprehend the expenses and whether an IUL policy straightens with your financial goals and demands. Whether Indexed Universal Life Insurance (IUL) is "worth it" is subjective and relies on your economic goals, danger tolerance, and long-term planning requirements. Right here are some indicate consider:: If you're seeking a long-term financial investment car that provides a survivor benefit, IUL can be a good choice.

1 Your policy's cash money worth should be enough to cover your regular monthly charges - IUL tax benefits. Indexed universal life insurance policy as utilized right here refers to policies that have actually not been registered with U.S Stocks and Exchange Payment. 2 Under current federal tax regulations, you might access your cash money surrender worth by taking federal income tax-free car loans or withdrawals from a life insurance policy plan that is not a Modified Endowment Contract (MEC) of up to your basis (total costs paid) in the policy

How does Iul Protection Plan work?

If the policy lapses, is given up or becomes a MEC, the car loan equilibrium at the time would generally be considered as a distribution and as a result taxable under the basic rules for distribution of policy cash values. This is a really general summary of the BrightLife Grow item. For prices and even more total information, please contact your monetary expert.

While IUL insurance policy might verify important to some, it's important to understand exactly how it functions before purchasing a plan. There are a number of benefits and drawbacks in comparison to other forms of life insurance policy. Indexed universal life (IUL) insurance policies supply greater upside prospective, adaptability, and tax-free gains. This kind of life insurance coverage provides permanent coverage as long as costs are paid.

What does a basic Iul Calculator plan include?

business by market capitalization. As the index relocates up or down, so does the price of return on the cash money value part of your policy. The insurance coverage business that provides the policy might offer a minimal guaranteed rate of return. There may additionally be a ceiling or rate cap on returns.

Financial specialists frequently advise having life insurance policy protection that's comparable to 10 to 15 times your annual revenue. There are a number of drawbacks related to IUL insurance plans that movie critics fast to explain. Somebody that establishes the policy over a time when the market is performing poorly might end up with high costs repayments that don't add at all to the money value.

Other than that, remember the complying with various other factors to consider: Insurance provider can set engagement prices for just how much of the index return you obtain every year. Allow's state the plan has a 70% engagement price. If the index expands by 10%, your cash money value return would certainly be just 7% (10% x 70%).

How can I secure Iul Cash Value quickly?

Additionally, returns on equity indexes are usually covered at a maximum amount. A policy may claim your maximum return is 10% per year, regardless of just how well the index performs. These restrictions can limit the real price of return that's credited toward your account annually, despite how well the policy's hidden index carries out.

IUL plans, on the various other hand, deal returns based on an index and have variable costs over time.

Latest Posts

Minnesota Life Iul

Seguros Universal Insurance

What Is Group Universal Life